Are you aspiring of owning your ideal home but facing hurdles with conventional financing? A private mortgage loan might be the perfect solution for you. These mortgages offer greater flexibility, check here allowing you to bypass strict lending criteria and secure your dream home faster.

- Private mortgage lenders often evaluate a wider range of factors beyond your financial history, such as your income, assets, and employment status.

- Whether are self-employed, have a unique financial situation, or need a rapid closing, private mortgage loans can be your key to achievement.

- With favorable interest rates and adjustable terms, you can design a loan that accommodates your specific needs and budget.

Don't let financing challenges stand in the way of your homeownership aspirations. Contact us today to discover more about how a private mortgage loan can help you achieve your homeownership ambition.

Private Mortgage Lenders: Financing Solutions for Every Situation

Navigating the real estate financing market can sometimes feel like traversing a challenging maze. Traditional lenders often have limited criteria, which can bar borrowers who don't fit their standard mold. This is where private mortgage lenders come into play. These lenders offer a wide range of mortgage solutions tailored to meet the individual needs of borrowers in all kinds of circumstances.

- Private lenders are known for their adaptability, often considering factors that conventional lenders might overlook.

- Regardless of you have non-conforming credit, self-employment income, or are looking to a purchase property, there's a good chance a private lender can provide the funding you need.

- Before diving into the world of private mortgages, it's crucial to compare lenders and discover a lender who is a good alignment for your circumstances.

Unlocking Homeownership: Bad Credit Home Loans Made Easy easy

Dreaming of owning a home but struggling with less-than-perfect credit? Forget about it? You're not alone. Many aspiring homeowners face similar obstacles. The good news is that there are specialized financing options designed to help you achieve your homeownership goals, even with bad credit.

These specialized mortgage products understand that credit scores aren't the only indicator of a borrower's financial stability. Lenders look at your overall financial picture to determine your ability to manage a loan.

Consider these popular options:

* **FHA Loans:** Backed by the Federal Housing Administration, FHA loans offer flexible lending criteria.

* **VA Loans:** Available to eligible veterans, active-duty military personnel, and their spouses, VA loans often require no down payment and have favorable interest rates.

* **USDA Loans:** Designed for borrowers in designated areas, USDA loans offer zero-down payment options.

Getting a mortgage with bad credit may take a little extra effort, but it's certainly achievable. Don't let a less-than-perfect credit score prevent you from realizing your dream of homeownership.

Private Home Loans : Quick Financing, Flexible Terms

Searching for a new home? Need mortgage financing quickly and with terms that suit your unique situation? Private home loans could be the perfect solution. These mortgages often offer rapid approvals and versatile terms that can address your particular requirements.

- Discover private home loan options today and see how they can help you achieve your homeownership dreams.

Acquire Funding Today: Private Mortgage Options for All

Are you seeking alternative mortgage paths? In today's evolving market, traditional lenders may not always meet your unique needs. That's where private mortgages step in! Alternative mortgage products can provide a adaptable solution to homeownership. With private mortgages, you have the ability to bypass tighter lending criteria and secure funding particularly when facing complex scenarios.

- Discover the perks of private mortgages and what they can help you realize your homeownership goals.

- Speak with our knowledgeable mortgage advisors to discuss your personal profile and determine the most suitable private mortgage plan for you.

Initiate your journey to property acquisition today!

Filling the Void: Private Mortgages for Challenging Financial Situations

Navigating the dilemma of acquiring a mortgage can be daunting, especially when facing financial setbacks. Traditional lenders often impose stringent criteria that may prove impossible for individuals with less-than-perfect credit or unique situations. Despite this, private mortgages offer a viable alternative, providing a path to homeownership even in difficult financial waters.

These loans are customized to meet the specific needs of borrowers, assessing factors beyond just credit scores. Independent mortgage brokers often offer more flexible terms and requirements, enabling them a valuable tool for those who encounter challenges with traditional lending.

Private mortgages can be a game-changer for individuals aiming to achieve their dream of homeownership, even in the face of financial challenges.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Hailie Jade Scott Mathers Then & Now!

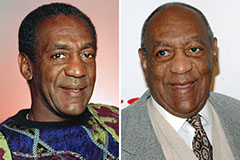

Hailie Jade Scott Mathers Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!